More About Federated Funding Partners Reviews

Table of ContentsFederated Funding Partners Bbb Fundamentals ExplainedHow Federated Funding Partners Reviews can Save You Time, Stress, and Money.Not known Facts About Federated Funding Partners BbbThe Buzz on Federated Funding PartnersNot known Details About Federated Funding Partners Legit

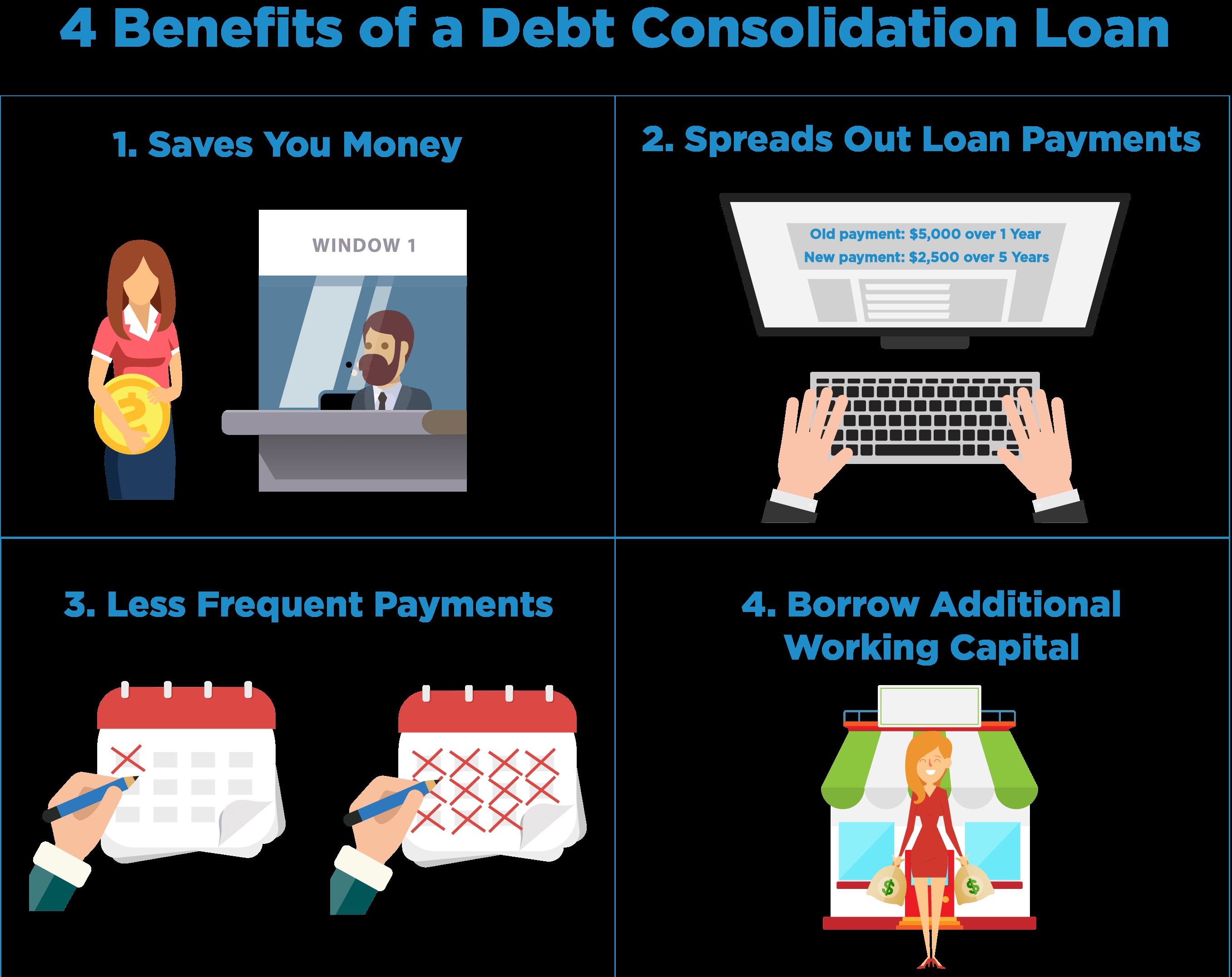

Some people thinking about an individual car loan feel bewildered by having several financial obligation payments monthly. A personal finance can lighten this load for 2 reasons. For one, it might be feasible to decrease the passion paid on the financial debt, which suggests it's possibly possible to save money in passion over time.

If it's possible to obtain reduced interest than you carry your present financial debt, or a shorter term on your financial debt to pay it off much faster, an individual car loan could be worth exploring. On the other hand, you'll likewise intend to be careful about costs that could feature your new financing, different from the rate of interest rate you'll pay.

The Ultimate Guide To Federated Funding Partners

Direct Combination lendings still certify for many federal loan securities as well as programs.

The Takeaway Debt loan consolidation permits debtors to integrate a range of financial obligations, like bank card, into a brand-new finance. Ideally, this brand-new car loan has a reduced rate of interest or even more better terms to help enhance the repayment procedure. In the long-term, financial debt combination might possibly assist individuals invest much less cash over the life of the lending, if they are able to protect a lower rate of interest on the consolidation loan.

9 Easy Facts About Federated Funding Partners Shown

If you are unable to meet multiple charge card repayments as your rate of interest payments raise or if you simply wish to relocate from a credit history way of life to a cost savings way of life, it may be time to combine your charge card payments so you can erase your charge card debt. Debt consolidation suggests to bring every one of your balances to a solitary expense as well as it can be a helpful way to handle your financial obligation.

Know your existing credit debt status The primary step is to take supply of simply what you owe as well as what your regular monthly take home salary is. Begin tracking what you owe as well as what you earn, to get a deal with on what's coming in, going out, and also how much is left over on a regular monthly basis.

Ways to consolidate your credit score card debt Pushed by your understanding of your funds, you can start to pick the debt combination method that works best for you. Financial obligation therapy solutions You may likewise locate several choices via debt therapy solutions, something several individuals rely on when they see that their credit history card debt surpasses their earnings.

Excitement About Federated Funding Partners

Once you site web commit to a repayment plan, your financial debt counselor may be able to assist place a quit to financial obligation collection letters as well as telephone calls (federated funding partners reviews). Meeting the repayment terms that a financial obligation counselor collections might boost your credit report. Negative aspects of financial debt therapy services: Till you settle your debts through useful content the accepted debt counseling debt consolidation strategy, you generally will not be able to open up or get any type of brand-new credit lines or finances.

With either approach, when you have actually completely repaid either the card with the biggest balance or the card with the highest possible APR, you schedule that same monthly settlement and also route it at the following bank card in line. This tactical method can help consumers with many credit cards, lowering the bigger problem cards (larger balance or larger rate of interest rate) first and after that rotating towards the next-biggest trouble card: consolidating your debts as you go.

How Federated Funding Partners Reviews can Save You Time, Stress, and Money.

DIY financial debt loan consolidation is terrific for those that feel they can pay for a project to repay their financial obligation, while still accruing rate of interest fees on their existing balances. Yet it might not work if you are already battling to fulfill minimal repayments or your credit report card equilibriums. DIY financial obligation loan consolidation calls for unwavering resolution to pay off bank card equilibriums, and a capability to regularly track as well as handle spending plans and funds.

Charge card equilibrium transfer Transferring your equilibriums can be a means to decrease the passion repayments from your current debt cards, yet any type of equilibrium transfer need to be made with great care. If you understand your present bank card' APRs, it ought to be simple to recognize a brand-new charge card that offers both (1) a lower APR and (2) a capability to transfer existing equilibriums.

Understand what your particular equilibrium transfer strategy will cost you before you commit to consolidating your debt through an equilibrium transfer. Introductory 0% APR credit rating cards are just one of the most economical methods to YOURURL.com transfer an existing bank card equilibrium, as they will not bill any type of passion versus your account up until the introductory duration mores than.